“Specialized Investment Funds” are a recent addition to the investment kitty approved by SEBI, These are helpful for smaller investors who found PMS(Portfolio management services), AIF(Alternative Investment Fund) entry level 1cr/50lac respectively not achievable.

🌱 SIF has a mind of a mutual fund with the benefits of PMS built into it, So if a scripts(share) is going down then SIF can bet money on it as short sell also(mutual funds aren’t allowed this)

🌱 The SIF starts at 10 Lakhs

🌱 Managed by licensed advisors only

🌱 With taxation now above 12.75 lakhs/annum and disposable income increased this can be a go to product for people who found PMS/AIF expensive.

🌱 Investors with a higher risk appetite than those of MFs can choose them.

The Trump & Tariffs (A simple version)

📍India is ranked 9th in terms of export deficit (nations which export more than they import from US).

📍 The deficit for US is approx. 3.6% ( imports in US by India is this much more than US exports to India).

📍US has put a 25% each tariff for Canada and Mexico(a ₹100 product sent from them will have a ₹25 tax which has to be payed by the exporter) similarly China with 10% tariff.

📍The Canada and Mexico tariff(starting 4th) have been paused for next 30 days and China’s tariff will start from 10th Feb.

📍China though is the largest exporter to the US but has only 10% tariffs because it’s so deep in products that higher tariffs on Chinese products could effect inflation in US.

📍China has also imposed a retalitary tariff on US as high as 15% on coal, crude, large EV’s(Tesla cyber truck) and has initiated a monopoly investigation on “Google”.

What’s in it for India

☘️ Electronics being the highest of exports category from China can be dainted, We already have a PLI scheme running and mobile phone manufacturing infra being upgraded from last couple years, This can be a bolster for the mobile industry.

☘️ India in the budget has cut down on taxes for American made motorcycles this was done earlier(last Trump regime) also and now has been further slashed.

☘️ Modi is to meet Trump this month, They can finalize a trade deal. Both sides have shown hints(US not putting India on tariffs)

SIP 10-10-10 RULE

☘️ 10 Years

Invest in a SIP for minimum of 10 years, this more the merrier as the compounding would have the cherry on top after these years.

☘️ 10 % XIRR

Expect a return of 10% annually, you may get 15-18% depending on the markets performance but calculate your investments at 10% for future endeavors.

☘️ 10% Step Up

Have a minimum of 10% added to you SIP amount annually, this would make the investments grow broader and the returns handsome.

i.e.: If you have a salary of 50 K. With a SIP of 15K, Make it 16.5K the next year and an extra 10% subsequently.

A Small Cap story

The current market has seen the small caps plunged to a 20% down from ATH(All time high)

Small Cap – These are the stocks which rank from 250th to the smallest company in ranking of “Market Cap”

Market Cap – It’s the total sum of the count of shares issued by a company multiplied by the value(current) of share or share price.

Story Continues –

So it happened that the small caps ruled the market from the great fall of March 2020 during the pandemic and since then some of them grew to levels of 100 PE (means their value was 100 times their earnings) which means they were overvalued by almost hundred times.

Now the “bears” have officially taken over the small caps and a rule of almost 4 years comes to an end.

Small caps are great value for money once they are at a fair price.

Disclaimer :

“This information is for educational purposes only and does not constitute financial advice. Investing in equities involves significant risk, and past performance is not indicative of future results. Always conduct your own research and consult with a financial advisor before making any investment decisions.”.

Tuesday Treasures

-1992: Stock market crashed 53%. – Harshad Mehta Scam

-2000: Stock market crashed 20% Dot-Com Bubble Burst

-2008: Stock market crashed 60%Global Financial Crisis

-2016: Stock market crashed 6%. (Demonetization)

-2020: Stock market crashed 38%. (COVID-19 Pandemic)

But it recovered to a new all-time high each time

Don’t let short-term fear control your long-term decisions

The financial diabetes – Inflation

₹1 Cr Today @7% inflation

– In 10 year= 50 Lakhs.

– In 15 years= 36 Lakhs.

– In 20 years = 25 Lakhs.

There are some insurance plans promising some fancy amounts that sound good today, beware of them. They don’t factor inflation and prey on customers’ innocence.

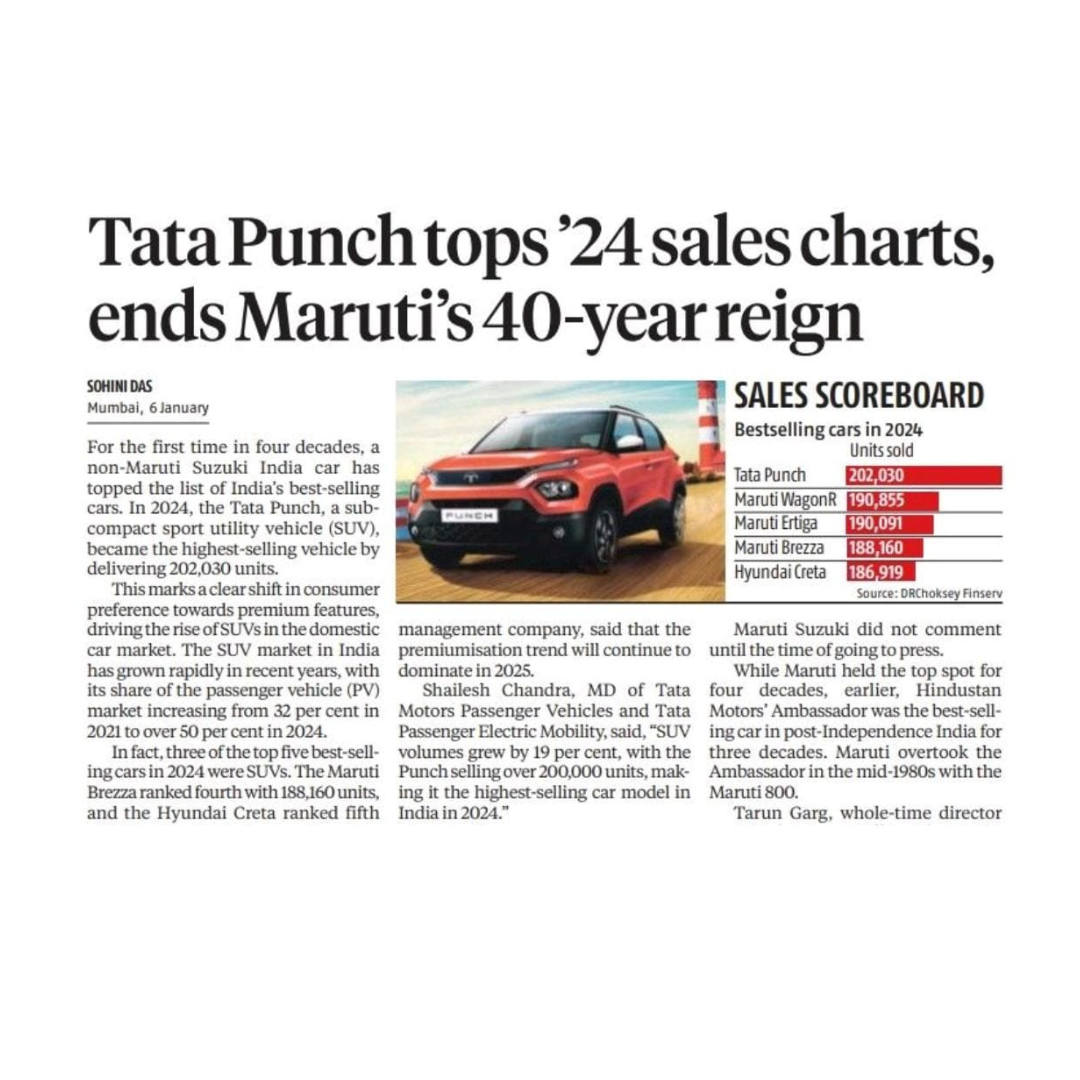

It took a car company 40 years to break the shackles of the market dominance by Maruti.

Ambassador was the brand ruling for almost three decades before Maruti 800 dethroned it in late 80’s

Learnings

- Manufacturers should be able to see the “design shift” in customer preferences

- Economic situation shifts and purchasing parity( amount one is willing to shed for an upmarket version) in this case customer shift to SUV should be monitored.

The Indian mid size SUV is a new kind of market, as per our average height of 5.6ft approx. Indians have created a mid/compact SUV industry.

GDP – Gross Domestic Product

-The total value of everything produced in a country. Or the total income of a country.

How can we calculate GDP

– Adding up the value of any thing that is produced in a country (Goods and Services) anything bought in a household, All expenditure by government, Exports, Investments in business as per records.

OR

– Adding up all the wages(salaries) and the profits(in case of companies)

Once we divide the GDP with the Population we get the Per Capita Income.

India GDP – $ 3.7 Trillion

Per Capita – $ 2590 approx

Market Outlook – Oct 24

- FII withdrawal was the highest with more than 1.1 L Cr

- MF Industry saw total AUM reaching 68L Cr

- Monthly SIP book crossed 25K Cr

- Debt Funds saw a highest inflow of 1.5L Cr

- We now have a national figure of 10 Cr investors in MF

FII – Forigen Institutional Investors( overseas mutual funds/banks/insurance companies)

MF – Mutual Fund

AUM – Asset Under Management (overall value of the amount invested in a fund/funds)

SIP Book – Total amount of funds going in monthly SIP

Debt Funds – Funds exposed to debt(loans/borrowers)instruments only(safer funds)

Trump – Economic Implications

Donald J Trump has made history with taking up a second term in office and being non – consecutive president to do so after almost 130 years. Let’s see how does it effects us as Indians

Fiscal Policy :

Our internal economics and fiscal deficit largely depends on the oil pricing and the amount of IT exports that fuels dollars into our system.

Trump Modi Bonhomie:

It has been said that Modi has a better chemistry with Trump in comparison to Biden, Well tell me a world leader except china and Pakistan where Modi’s hug isn’t prominent(nothing changes there). Moreover Trump’s “America First” rhetoric would/might hamper visas and tariffs on any kind of imports.

The major arguable factor is “China” where Trump has clearly mentioned a cut in Chinese goods and also advocated humongous tarrifs. The major stock markets around the world hailed(shot up) Trump’s re-election with an exception of the China and Hong Kong markets that fell more than 2%. So the case is more of “COMPETITOR’S LOSS IS OUR GAIN”.

- The US India policy would largely remain unchanged as the US is eying china +1 bolster for its imports and supply chain.

- There would be tariffs hike on imports to help US industry. A china specific hike would be a boost for India

- Tariffs would be a double edged sword with Trump asking to lower it in US export to India (Harley Davidson case, Where Trump personally wanted the import duty for Harley to be cut off substantially, Later honoured by India.

- Production shift from china to India would be a major contributor. Though it is already happening gradually. Trump might help it speed up, But there are other south asians eying to eat the pie like Vietnam and Indonesia.

- A hard hand on China would also mean fresh flow of FDI(foreign direct investment) to India.

- Our dollar remissions might take a daint if the H1 visa issuance faces scrutiny. The last Trump’s administration has had similar examples.

I have intentionally spared Pakistan in this equation as it would mean a lot on the economic scenario, It would be more of a geo-political impact not resulting largely in the economy.